BorgWarner to Buy Delphi Technologies

Electrification, economies of scale and other synergies drive deal

Auburn Hills, Mich.-based BorgWarner has agreed to acquire Delphi Technologies to bolster its electrification capabilities.

The all-stock, $1.5 billion deal, which is expected to be completed in the second half of 2020, values Delphi at about $3.3 billion. Current BorgWarner stockholders will own about 84% of the combined operations, while their Delphi Technologies counterparts will hold the remaining 16%.

Here are a few takeaways:

Size Matters

Last year, BorgWarner and Delphi Technologies generated nearly $10.2 billion and $4.4 billion in net sales, respectively. The combined total of $14.5 billion would have made BorgWarner the 15th-largest global automotive supplier, pushing it up seven slots from its stand-alone ranking in Automotive News’ 2018 tabulation.

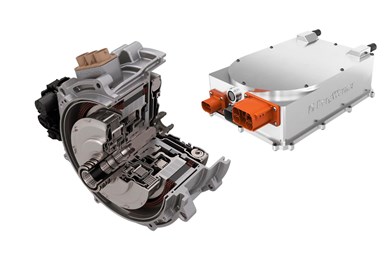

BorgWarner says Delphi’s products will complement its own electrification portfolio that includes a hybird P2 module (left) and on-board battery charger (right).

Supersizing its operations gives BorgWarner greater financial wherewithal to fund research and development and expand into new markets. It also gives the supplier access to additional engineering resources, provides greater economies of scale, strengthens its product portfolio and enhances sales opportunities across markets, regions and customers.

BorgWarner expects the deal to yield “meaningful” improvements to shareholder value within about two years. Cost savings are projected to total $125 million by 2023.

It’s Mostly About Electrification

The combined company will offer a comprehensive portfolio of propulsion products for light and commercial vehicles and aftermarket applications.

On the ICE side, potential synergies include teaming BorgWarner’s turbocharging and exhaust gas management technologies with Delphi’s fuel injection and electronics control expertise.

But the real key to the deal is electrification. Combining the two companies’ current offerings—including high voltage inverters, converters, electric motors, on-board chargers, battery management systems and software—would enable BorgWarner to supply an integrated drive module for hybrid and full-electric vehicles.

“We will create differentiation by offering everything under one roof,” asserts BorgWarner CEO Frederic Lissalde. He says Delphi has been ahead of the curve with its 800-volt inverter and other electrification technologies.

Delphi Needed a Boost

Delphi Technologies has struggled to gain its footing since the company was divested from the former Delphi Automotive in 2017. The split left Delphi with various powertrain technologies, while the newly created Aptiv got dibs on advanced driver assistant systems and other safety technologies.

Preliminary estimates show Delphi’s sales fell 10% year-over-year in 2019, about one-third of which is attributed to unfavorable currency exchange rates.

To help get back on track, the company announced a restructuring plan in October that aims to slash $150 million in costs by 2022. At the time, CEO Richard Dauch said the company needed to act with “increased urgency” to improve its financial performance and realign its engineering footprint.

More to Come

BorgWarner, which saw its sales decline 3% last year, is in the midst of its own restructuring and cost-cutting efforts. Details are expected to be announced in coming weeks (the $125 million target for the combined operations is in addition to what the two companies already have planned on their own).

What’s clear is that BorgWarner is increasingly focusing on electrification technologies. The move started in 2015 with the company’s $950 million acquisition of Remy International, which was followed by several smaller purchases.

The Delphi deal accelerates these efforts.