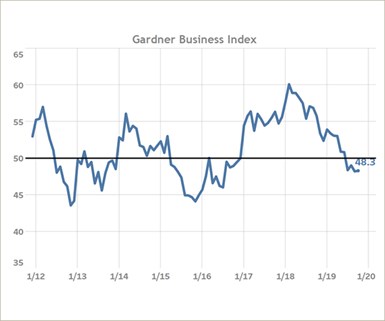

October Sees Moderate Contraction, but Growing New Orders

The GBI for October was 48.3, signaling a fourth month of mildly contracting business activity across the U.S. manufacturing sector. However, total new orders continue to do well. Based on a three-month moving average, the best performing end-market as of October was aerospace, followed by medical equipment manufacturing. The market for construction machinery continued to experience the fastest rate of contracting business activity, mirrored by a similarly enduring contraction in the industrial motors market.

#economics

RELATED CONTENT

-

Tariffs on Autos: “No One Wins”

While talk of tariffs may make the president sound tough and which gives the talking heads on cable something to talk about, the impact of the potential 25 percent tariffs on vehicles imported to the U.S. could have some fairly significant consequences.

-

Enterprise Edges into Self-Driving Car Market

U.S. rental car giant Enterprise Holdings Inc. is the latest company to venture into the world of self-driving vehicles.

-

On Headlights, Tesla's Autopilot, VW's Electric Activities and More

Seeing better when driving at night, understanding the limits of “Autopilot,” Volkswagen’s electric activities, and more.