Questioning the Electric Vehicle Orthodoxy

According to “experts,” it’s all over for the internal combustion engine. Apparently, they haven’t been paying attention to what’s been happening behind the headlines.

#hybrid

I know what you’re thinking: “A powertrain story? Really? Everything is going electric, so why bother? The internal combustion engine (ICE) is all but dead.” Judging from the increasing number of column inches devoted to breathlessly promoting electric vehicles (EVs), a case could be made for writing off the ICE and preparing for the inevitable switch to electrification, one that starts with a wholesale move to plug-in hybrids (PHEVs) and is followed by a swift ramp-up to pure EVs. From there, ICEs are dead and buried, never to return. The end.

“If only it was that easy,” says J.D. Kehoe, Mahle North America’s Director of Product Development, Filtration and Engine Peripherals (us.mahle.com). “It’s a very dynamic time in the auto industry with different approaches from region to region that demand a blend of propulsion options that will be available for some time.” Kehoe can see a future where China leads in the advancement of battery electric vehicles, Japan pushes hydrogen fuel cells, Europe — where city centers from London to Paris and beyond — moves from banning diesel power to banning gasoline-engined vehicles as well, while the U.S. — where gasoline is both plentiful and relatively cheap — will continue on a path that increasingly combines turbocharged, downsized ICEs with hybrid drive systems. Which is not to say that there won’t be a level of cross pollination as EVs, fuel cells and ICEs mingle in the marketplace.

“The push toward EVs in China and Europe,” says Kehoe, “is being driven by proposed legislation. The challenge in a global market is the acceptance of those technologies in other regions.” For example diesel, which — with the help of legislation — until recently accounted for as much as 60 percent of Europe’s passenger vehicle market, never really caught on in Asia or North America, and European automakers were forced to not only supply a greater proportion of gasoline-powered vehicles in these markets, but to create hybrid models they didn’t sell at home. It’s why, unlike VW and its MEB modular EV platform, BMW’s two newest architectures, known internally as “FAAR” and “CLAR,” will be “multi-fuel” platforms that will support ICE, PHEV and full electric powertrains. As BMW platform strategist Lutz Meyer recently told Britain’s Autocar magazine, this strategy is essential due to the inability to predict “with any accuracy” the rate at which buyers will shift to EVs, and the need to meet the demands of individual markets.

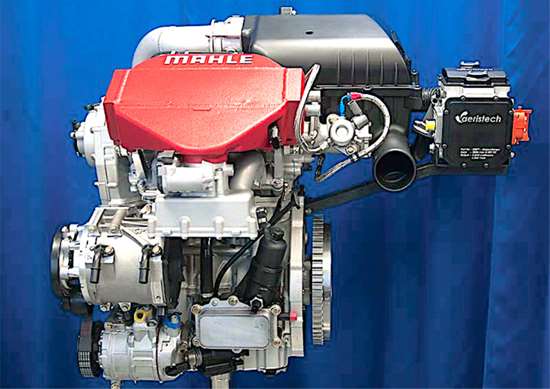

This puts a lot of pressure on suppliers as they struggle to cover all the bases, especially as profitability in these new areas remains elusive. Over the past few years, Mahle purchased a controlling interest in Letrika, Kokusan Denki and Nagares, and combined them in a new Mechatronics division to handle everything from starters and alternators, to fuel injection systems and electric motors, to charging systems and motor controllers. This was done to keep pace with the changing automotive landscape. According to Kehoe, “The ICE side of the business is supporting our investment in electric drive systems until such time as consumer demand for electric vehicles makes this no longer necessary. Should that equation reverse, we will do the same to support our ICE research and development. As long as there is demand for either, we will be there to support it.”

He says, however, that this uncertainty has brought with it another change, a more open dialog between OEM and supplier. “In the past,” he says, “it used to be, ‘This is what we need,’ because most automakers knew what their boundary layer conditions were. They knew what they needed.” Now, however, the statement has turned into a question: “What’s possible?” Says Kehoe, “There’s a lot more interest in getting ideas on the table, seeing how they fit into their systems, and determining what that means for the subsystems. Just 10 years ago we never heard a question we are hearing a lot now: ‘Here’s what we’re thinking. Is this even possible?’”

The expectation is that powertrain technology will follow three paths: downsizing, hybridization, and electric drive. Pure electric drive is a standalone, and one that is being driven by legislation, which has a major impact on customer acceptance. Conversely, continued downsizing and hybridization are not only increasingly common, the technologies are complementary. “There’s a lot of cost balancing going on,” says Kehoe, “in terms of what’s possible, performance, market penetration and differentiation. There are a lot of choices, but — unlike in the past — not everyone is looking at the same page of the menu.” Nor will they necessarily come up with the same solutions.

In 10 years, says Kehoe, there will be a mix of powertrains ranging from ICEs to pure electrics. The distribution of each, however, will depend upon the region, legislation, consumer acceptance, and — ultimately — cost. Even so, he imagines a situation similar to that seen in computers, where desktops and laptops have been overtaken by tablets and smartphones. “It may not happen to the same degree with powertrain,” he admits, “but the range of options available to the consumer will certainly increase, making this one of the most exciting times in automotive history in terms of the potential for change.”

RELATED CONTENT

-

Internal Combustion Engines’ Continued Domination (?)

According to a new research study by Deutsche Bank, “PCOT III: Revisiting the Outlook for Powertrain Technology” (that’s “Pricing the Car of Tomorrow”), to twist a phrase from Mark Twain, it seems that the reports of the internal combustion engine’s eminent death are greatly exaggerated.

-

Bolt EV: Like a Hammer Through a Screen

Some of you may remember the Apple “1984” commercial that ran on January 22, 1984, the ad that announced the Macintosh to the world.

-

FCA Opens the Door to The Future

FCA introduced a high-tech concept vehicle today, the Chrysler Portal, at the event previously known as the “Consumer Electronics Show,” now simply CES.