on Designing and Executing for Function, Energy Effects on Manufacturing Costs, & an E-axle for Pickups

On the Citroën oli. . .the UBCO EV adventure bike. . .European energy costs. . .Stellantis and the circular economy. . .thin oil. . .Toyota C-HR review. . .ZF electric axle for pickups. . .

Citroën: Think Different

A concept EV with some highly intriguing ideas. (Image: Citroën)

A couple weeks ago Citroën introduced a concept EV, the oli. While the name may not ring any bells, you’ll probably remember reading something along the lines of, “The vehicle is made of recycled cardboard!” with an implicit “Har! Har! Har!”

Yes, the hood, roof and pickup box panels are made with recycled corrugated cardboard, but the material isn’t simply a bunch of Amazon boxes taped together.

There is a honeycomb sandwich made with fiberglass reinforcing panels created along with BASF. They are coated with a BASF Elastoflex polyurethane resin, coated again with an Elastocoat material (apparently used to coat parking decks) and then painted with waterborne BASF R-M Agilis paint.

According to Citroën the 6-kg roof panel is strong enough for an adult to stand on it.

Some cardboard.

Why This Exists

It is worth revisiting the oli is because of what wasn’t typically reported: the rationale for this type of essentialist vehicle. After all, concept cars are often exotic and swoopy, not geometric and utilitarian.

Citroën CEO Vincent Cobée:

“Citroën believes electrification should not mean extortion and being eco-conscious should not be punitive by restricting our mobility or making vehicles less rewarding to live with. We need to reverse the trends by making them lighter and less expensive and find inventive ways to maximize usage and refurbish for subsequent owners. Otherwise, families won’t be able to afford the freedom of mobility when all-electric vehicles become the only option available to them. oli is a powerful demonstration of how Citroën is confronting these conflicts head-on and with optimism.”

. . .which was echoed and amplified by Laurence Hansen, head of Citroën Product Development:

“You can choose to pay for all of the latest features and artificial intelligence which you only use 2% of the time when driving, or you can ask yourself ‘what is the responsible thing to do and how much of this do I really need?’ oli is a way to say ‘enough!’ I do want something innovative, but I want it straightforward, affordable, responsible and long lasting.”

Hyperbole aside, it is worth considering.

The vehicle:

- Is 4.2 meters long, 1.65 meters high and 1.9 meters wide

- It has a target vehicle weight of 1,000 kg

- There is a 40-kWh battery

- Target range: 400 km

- Top speed is limited to 110 kmh

Inside

One place where simplicity is evident (and sensible) is in the interior.

The instrument panel is a beam that runs the width of the vehicle. Rather than an array of screens, there is a smart phone dock and several USB ports.

The smart phone is the means of achieving infotainment. What’s more, it connects with the vehicle so that information like speed and amount of charge are run thought it and projected onto the lower portion of the windshield.

As Pierre Sabas, head of Citroën Advanced Design and Concept Vehicles, puts it:

“Because your smartphone has more computing power than many vehicles, we decided to adopt a different approach to infotainment. We all carry our phones and use apps for navigation and entertainment already, so we saw a chance to save the expense, duplication and weight of integrated systems. Just bring your own device and plug in.”

Maybe something specifically like the oli won’t be developed.

But it is thinking like that which is immensely valuable.

>>>

Functional EV Adventure Bike

This electric bike has a highly functional design aesthetic. (Image: UBCO)

If you look at that Citroën concept vehicle in the previous item and then the UBCO 2x2 Adventure motorbike, you may discern some design similarities between the two electric vehicles.

Seems that there is something to be said for the straight-edge look.

And for vehicles that put function ahead of fanciness.

Listen to Phil Harrison, chief revenue officer of UBCO:

“Micromobility is going through a reckoning, partly as a result of poorly designed hardware that's not built to last. Product lifecycle thinking drives UBCO's development right from design through to simplifying maintenance for owners.

“This has helped us push the limits with our new model having 30% better battery cyclic longevity, improved design for disassembly, 20% better motor efficiency, strengthened frame, and more sustainable packaging. Having a smaller form factor and doing more with less, is an important pillar of more sustainable consumption.”

“Product lifecycle thinking?”

Again, the Citroën oli concept comes to mind.

The Bits

The bike has a 7027 aluminum-alloy frame and 316 stainless steel components.

It has a 1-kW, brushless DC motor in each wheel. It has a lithium-ion battery pack—either 2.1 kWh or 3.1 kWh—based on LG 18650 cylindrical cells.

Practical Approach

It describing the range, the folks from UBCO point out that because it is a high-torque, low-speed system, the 2x2 has its best efficiency below top speed—and its top speed is 30 mph.

The range is 75 miles. . .assuming a steady speed of 20 mph (and the 3.1-kWh battery).

Although that may seem, well, slow, realize that (1) this is an off-road adventure bike that (2) is probably going to spend a not-inconsiderable amount of time in congested urban areas, too. So the slow go is the way to go.

>>>

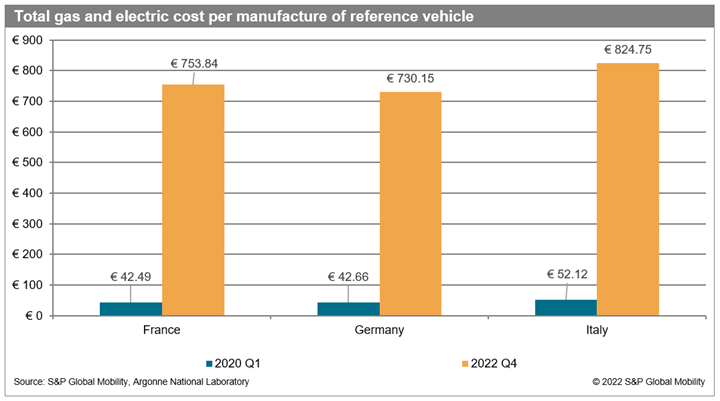

Energy in Europe & Auto: This Doesn’t Look Encouraging

The effects of these utility costs not only impact disposable income but the price of manufacturing things like cars. (Image: S&P Global Mobility)

This seemed so extreme that we checked with Edwin Pope, principal analyst, Materials & Lightweighting at S&P Mobility, to make sure that we weren’t in error.

The energy to build a vehicle in Europe—prior to both the COVID 19 pandemic and the Russian invasion of Ukraine—put about €50 per vehicle on the bill of materials.

Now it is €687 to €773 per vehicle.

Yes, from €50 to ~€687.

Those companies that are involved in stamping, welding and/or extrusion, which require serious amounts of energy, are seeing the huge cost rises.

“Anecdotally,” Pope says, “we’re hearing that some of this manufacturing capacity is becoming so uneconomic that companies are simply shutting up shop.”

S&P Mobility calculates that since Q1 2020 natural gas prices in Italy, Germany, France and the UK have increased an average 2,183%. Wholesale electricity prices are up 1,230%.

For the want of nail. . .

Pope points out, “Upstream supplier parts production constraints could impact OEM volumes. As a result, we see a risk of OEMs halting shipments of completed vehicles due to shortages of single components, which are not necessarily coupled to country-level energy policies.”

Time, time, time

The situation isn’t going to be resolved quickly.

S&P Mobility anticipates there will be supply chain disruptions starting next month and running through Spring ’23. What’s more (or less) is that just-in-time models are likely to be upset, with some suppliers working 24/7 for fractional months, which can be more energy-efficient than performing weekly shifts (as they include start ups and shutdowns).

Global impact

This won’t just have European implications.

Companies in the EU and UK send components to companies around the world.

What’s more, they export about 7,000 vehicles to the U.S. each month.

But for Europe, S&P Mobility says that OEM plants there could lose a combined 1-million units per quarter—starting in Q4 2022 and running through all of ’23.

>>>

Stellantis Addressing the Circle

Stellantis chief Carlos Tavares thinks that a circular approach to materials is not only good business but a corporate responsibility. (Image: Stellantis)

Stellantis, which owns the aforementioned Citroën (as well as Abarth, Alfa Romeo, Chrysler, Dodge, DS Automobiles, Fiat, Jeep, Lancia, Maserati, Opel, Peugeot, Ram, Vauxhall, Free2move and Leasys), is nothing if not aggressive when it comes to reducing carbon emissions:

The company plans to be carbon net zero by 2038, according to CEO Carlos Tavares, who refers to this as an “ethical goal.”

And on its way to getting there, it plans to have 100% of its vehicle sales in Europe to be battery electric vehicles by 2030. And 50% in the U.S.

Stellantis has established the Circular Economy Business Unit.

Alison Jones, senior vice president of the unit, says that the intent is to achieve annual revenues of €2 billion by 2030.

How?

Through four activities:

- Remanufacturing. Here, Jones explains, it is about taking things like used, worn and defective parts and bringing them back to OEM spec. At present the company has applied this to some 12,000 parts covering 40 product lines. She says there is significant growth in this area.

- Repair. Rather than new, these worn parts are repaired and reinstalled in customer vehicles. They have established repair centers specifically for EV batteries.

- Reuse. According to a company FAQ: “B-Parts is a leader in the online distribution of used auto parts. Our parts come from damaged cars, ready to be reused in other vehicles. All parts sold by B-Parts are original (OEM) and have a warranty.” B-Parts is part of Stellantis. Jones says there are some 4.5-million multi-brand parts in inventory and sold in 155 countries through the B-Parts channel.

- Recycle. This is taking scrap from manufacturing and end-of-life vehicles and using the material in the production of new products.

Next year at the Mirafiori Complex in Italy Stellantis will launch a “Circular Economy Hub.” This operation will undertake vehicle reconditioning, vehicle dismantling, parts remanufacturing, and other activities.

Smaller, more-focused hubs (e.g., starter motors and alternators are remanufactured in a facility in Brazil and then sold throughout the country) will be established.

Stellantis has also created a new label for parts and accessories that are part of its circular initiative: SUSTAINera. Life-cycle analyses are being conducted to determine the materials and energy savings of these parts, based on a methodology from Sphera, a global Environmental, Social and Governance (ESG) consulting organization.

While not everyone might want something that has been renewed, Jones says that there is a growing number of people who are interested in sustainable approaches.

>>>

Can You Be Too Thin?

On the way to better oils. (Image: Liqui Moly)

Actually the pronoun “you” in that headline should be “it.”

And that would be the stand-in for “motor oil.”

Turns out, the answer is “yes.”

Oliver Kuhn, Deputy Head of the Oil Laboratory at LIQUI MOLY, explains that efforts are being made to make oil thinner—for vehicle emissions considerations.

Kuhn: “The thinner a motor oil is, the less force the engine needs to apply to pump it. This reduces fuel consumption. The effect isn’t huge, but thin oil is one of many adjustments the auto makers make to increase the efficiency of their vehicles.”

Additive Advantage

Motor oil, he explains, primarily consists of the base oil and additive packages.

Turns out the additive packages just aren’t marketing gimmicks but actually the most important constituent:

“They are not only responsible for the cleaning and corrosion protection with thin-bodied oils, but also for cooling and lubrication. The base oil, i.e., the actual oil, is then hardly more than just a carrier fluid for the additive packages.”

Thick or Thin?

If the motor oil is too thick, the oil pump has to work hard pushing it through small oil packages. The pump could fail.

But if it is too thin for the engine, then it can break down: “A cracked oil film means significantly increased wear, which can extend to seized bearings.”

The Thinnest Oil

Kuhn says that the lowest viscosity motor oil available—and it is only in the Japan market for gasoline engines—is 0W-8.

Kuhn:

“This is almost a single-grade oil. In addition to lubrication, the difficulty here is above all evaporation, because the thinner an oil is, the easier it evaporates. With the 0W-8, this balance can just about be maintained. For even lower viscosities, it would probably require a completely different chemistry, which would then no longer be based on oil.”

>>>

2022 Toyota C-HR Limited

Look carefully to discover the rear door handle on the C-HR. (Image: Toyota)

The Toyota C-HR had its debut, as a concept vehicle, at the 2014 Paris Motor Show. That is something that should be kept in mind when thinking about this subcompact crossover. The other marques that had concept vehicle in Paris that year were Audi, Citroen, Infiniti, Lamborghini, Mitsubishi, Peugeot, and Renault. So realize that the people at Toyota weren’t just thinking of the U.S. market with this vehicle that had expressive styling then, when it was launched in 2017 as a MY 2018 vehicle, and after an exterior refresh for MY 2020.

When the C-HR concept came to the U.S., it was unveiled at the L.A. Auto Show in 2015 as a Scion, the then-youthful brand that Toyota had created. (And discontinued but a few months later, after a 13-year run.)

From the start the design has been far more expressive than what you might consider in this category.

Seriously Styled

One way to recognize how the C-HR is comparatively exotic in its category from an exterior styling point of view is to consider the door handles for the rear doors. If you look at the C-pillar in the photo above you can spot it. I guarantee that were you to see that vehicle in a full side view rather than this three-quarter you would have a tough time discerning where the handle is located.

Toyota has slotted the Corolla Cross between the C-HR and the RAV4. Arguably, the Corolla Cross is the stylistically least adventurous of the three. And while the RAV4 and the Corolla Cross are both available in AWD versions, the C-HR is FWD only.

But one could argue that for those who are looking for more than a little flair in their garage (or, more likely, in front of one’s apartment—47% of renters are under 30, which is likely to be the demographic that would be most interested in the C-HR), that drivetrain setup is probably not a deal-breaker: You are going to like the vehicle for its looks more than for its function.

Some Specs

Not that it doesn’t acquit itself in a reasonable manner. It has a 144-hp, 2.0-liter engine and a continuously variable transmission. Its estimated fuel economy is 27 mpg city/31 highway/29 combined. . .but 91 octane or higher is recommended (not required) which is somewhat unusual for a vehicle with a base MSRP of $24,280 and isn’t meant to be taken to a track or even participate in extreme asphalt weekend endeavors.

It has passenger volume of 86 cubic feet and cargo volume behind the second row of 19.1 cubic feet and 37 cubic feet if the second row is folded.

The C-HR is, arguably, isn’t an acquired taste. You either like it or you don’t. Immediately.

One wonders: would it have been far more successful as a Scion than as a Toyota?

I’d say yes.

>>>

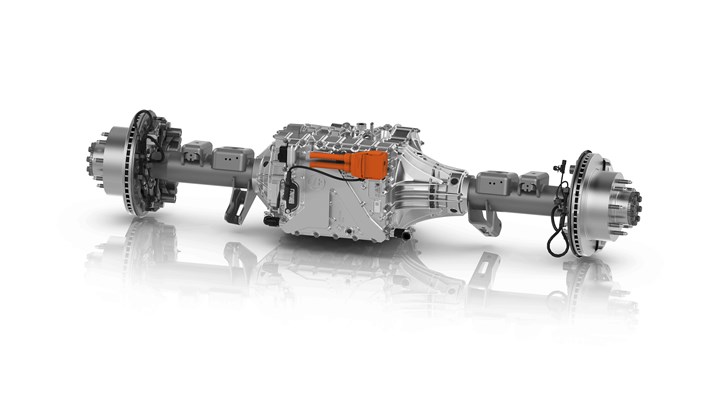

Truck Transformer: ICE to BEV

The ZF eBeam Axle can facilitate the transformation of an ICE pickup to a BEV version. (Image: ZF)

Here’s a nearly chicken-or-egg question:

Are electric pickup trucks wildly popular in the U.S.* because they are electric or is it because they are pickup trucks?

Given the seemingly insatiable demand for pickups it would seem the latter, but clearly there is a whole lot of interest in the former.

So to facilitate developing EV trucks, ZF has developed a solid axle that incorporates an electric motor, inverter and transmission.

It is called the eBeam Axle.

It is available in both 400- and 800-V architectures. It provides power up to 350 kW and torque up to 16,000 Nm.

The modular unit is designed for use in both existing as well as developing medium- and full-size pickups.

So it brings up the question (after all, the SEMA Show starts in little over a week, so knowing what people do to customize their vehicles. . .): could the eBeam be dropped into someone’s personal truck?

We asked Jörg Trampler, program director, Electrified Powertrain Technology, ZF Group.

He answered:

“While ZF ensures the same mounting point of the axle to the vehicle, the vehicle requires further modifications in order to be converted to a functional BEV; for example, removal of ICE powertrain, installation of batteries, and adaptation of auxiliaries (power steering, braking, etc.).

“In summary, the ZF eBeam is a very good solution for an OEM to build ICE and BEV trucks on the same platform, but would not work as an aftermarket solution for vehicle owners who want to convert their vehicles to BEV.”

Sorry, tuners.

==

*Consider: the still non-existent Telsa Cybertruck has an estimated 1.6-million reservations, according to Tesla Reservation Tracker (https://sites.google.com/view/tesla-reservation-tracker/home ). At the end of last year, before the Ford Lightning was available (it launched in April), Ford had 200,000 reservations and it (temporarily) closed the books to assure that the wait wouldn’t be exceedingly long (and through September it delivered 8,760). Rivian apparently has some 90K reservations, though that includes both the pickup and ute versions of the R1. Chevy has more than 150,000 reservations for the Silverado EV that won’t be out until next spring. Yes, people are quite interested in EV pickups.

/\/\/\

RELATED CONTENT

-

Ford Copies Nature

As Nature (yes, capital N Nature) has done a pretty good job of designing things, it is somewhat surprising that Man (ditto) doesn’t follow Nature’s lead more often when it comes to designing objects.

-

Mustang Changes for 2018

On Tuesday Ford unveiled—using the social media channels of actor Dwayne Johnson (this has got to unnerve some of the auto buff book editors)—the 2018 Mustang, which has undergone some modifications: under the hood (the 3.7-liter V6 is giving way to a 2.3-liter EcoBoost four, and a 10-speed automatic is available), on the dash (a 12-inch, all-digital LCD screen is available for the dashboard), at the tires (12 wheel choices), on the chassis (MagneRide damper technology is being offered with the Mustang Performance Package), and on the exterior (three new paint colors). And while on the subject of the exterior, there are some notable changes—a lower, remodeled hood, repositioned hood vents, new upper and lower front grilles, LED front lights, revised LED taillamps, new rear bumper and fascia.

-

Things to Know About Cam Grinding

By James Gaffney, Product Engineer, Precision Grinding and Patrick D. Redington, Manager, Precision Grinding Business Unit, Norton Company (Worcester, MA)

.jpg;width=70;height=70;mode=crop)