On Residual Value, Electrification Challenges, German Manufacturing and more

How quality and design affect value, why electrification still has some challenges, how the Brits define “autonomy,” why the ICE isn’t going away soon, which companies are not considered particularly green, and the experiential importance OEMs must address

#hybrid

This week On Automotive

- Quality, Design and Value

- Electrification, OEMs & Suppliers

- Clear, Simple Explanation

- German Digital Manufacturing Initiative

- Powertain Shift

- Harsh: Low Carbon Rankings

- Powertain Shift

///

Quality, Design and Value

2022 Honda Civic Touring. Enjoy driving it. And owning it because it has a high residual value. (Image: Honda)

“Accurately forecasting residual values in the auto industry is a key factor in assessing an estimated $225-billion lease portfolio in the United States.” So says Eric Lyman, vice president of ALG, the division of J.D. Power that calculates how well vehicles are expected to hold their value over a three-year period.

Not only is this useful for people who are calculating lease rates, but it is also valuable to consumers who are buying a vehicle, as this provides a metric regarding how much they should get for the vehicle when they sell. (Although let’s face it: COVID has made vehicle values uncharacteristically high.)

OEM Interest, Too

But what it also points to are two factors of interest to those who are involved in the execution part of the industry:

- Long-term quality

- Design

If the vehicle isn’t built right, then three years on the potential price at the service center will make it not appealing to the next customer.

If the design looks dated, then it is literally and metaphorically stamped with a sell-by date on it. . .that has expired.

ALG has evaluated 284 models from 19 brands in coming up with its 2022 Residual Value Awards. There are overall awards as well as model segment awards.

The top mass market brand: Honda.

What’s more, Honda achieved three model-level awards for the Civic, Passport and Odyssey. Only one other manufacturer had three: Hyundai, for the Accent, Kona and Kona EV.

The top premium brand is Lexus.

Although it received just one model-level award for the NX, Lyman said, “The achievement of Lexus speaks to an impressive, industry-leading continuity of residual value across its entire lineup. It’s like a decathlete who wins only one of the 10 individual events but scores enough points in each of them to stand atop the podium.”

Consistency has its own rewards.

Honda’s designs have been consistently good and the new Civic elevates that model compared to the previous generation.

Lexus design is, to put it gently, wildly controversial.

In both cases, the companies are known for their manufacturing quality.

Odds are that had a lot to do with their positions in the ALG assessment.

Another interesting pair of awards.

There are three segments in the truck category:

- Fullsize Heavy Duty Pickup

- Fullsize Pickup

- Midsize Pickup

GMC takes the first category with the Sierra HD.

As for the full- and mid-size: Toyota takes two with the Tundra and Toyota Tacoma.

While Ford and Chevy dominate the full-size category in terms of sales, ALG reckons the Tundra holds better value than the F-150 or Silverado. And while the Tacoma dominates the mid-size category in terms of sales, ALG figures that it will be more valuable than the others three years on.

///

Electrification, OEMs & Suppliers

Rivian: A non-traditional OEM may have an advantage over the traditional ones. (And after its IPO, it is more valuable than they are, too, though that may change.) (Image: Rivian)

Electrification is at the proverbial tipping point according to a global survey conducted last month by electronics company Molex.

In response to:

“Momentum is building and vehicle electrification is on the cusp of a huge breakthrough”

- 58% strongly agreed

- 35% agree somewhat

So. . .

93% have some level of agreement.

That said. . .

There are issues.

Asked about the challenges their companies face when it comes to finding the expertise needed to advance electrification (and given the opportunity to select all that apply, so the number is greater than 100%):

- 50% say that competition with tech companies makes hiring difficult

- 42% say traditional automotive suppliers don’t have sufficient electrification expertise

- 40% say finding leadership that understand the cultural changes needed is challenging

- 35% say suppliers that don’t have an automotive background “struggle” to work with automotive companies

To the issue of suppliers, it is interesting to note that only 21% say they’d prefer to work with a supplier that has deep expertise in electrification but no auto experience and 32% prefer to work with an established auto supplier that is new to electrification.

(No surprise: the remaining 47% want both expertise and experience.)

However. . .

Asked which statement reflects their opinion on the type of company that will dominate the EV market long term:

- 58% say “EV-only OEMS (Tesla, Rivian, etc.) are better equipped to own the EV market long term because they are more agile and don’t have to transition”

- 42% say “Traditional OEMs (BMW, Ford, etc.) are better equipped to own the EV market long term because of their experience and breadth

So arguably, experience is of so-so value.

Which should make both OEMs and supplies reassess their organizations and operations.

///

Clear, Simple Explanation

With the GM Super Cruise system—which the company clearly identifies as a “hands-free driver-assistance technology”—when the light on the steering wheel is green, it means the system is a go. When it turns red. . . . (Image: GM)

While the UK auto industry finds itself in a sad situation due to factors including COVID and Brexit, there is a certain bullishness about its advanced vehicle technology capability.

Says Mike Hawes, chief executive of the UK auto industry trade association Society of Motor Manufacturers and Traders (SMMT), “The UK is at the forefront of the introduction of automated vehicles.”

A comment people in, say, places like Silicon Valley, Phoenix and Pittsburgh might take exception to.

But be that as it may, it is worth acknowledging work performed by the Centre for Connected and Autonomous Vehicles’ AV-DRiVE Group, which has been published by the SMMT.

It includes a set of principles for those who are putting automated driving tech on the market:

- An automated driving feature must be described sufficiently clearly so as not to mislead, including setting out the circumstances in which that feature can function.

- An automated driving feature must be described sufficiently clearly so that it is distinguished from an assisted driving feature.

- Where both automated driving and assisted driving features are described, they must be clearly distinguished from each other.

- An assisted driving feature should not be described in a way that could convey the impression that it is an automated driving feature.

- The name of an automated or assisted driving feature must not mislead by conveying that it is the other - ancillary words may be necessary to avoid confusion - for example for an assisted driving feature, by making it clear that the driver must be in control at all times.

Making it clear what the parameters are is absolutely essential for the safe operation of this tech.

While people in the industry might use the SAE levels as shorthand, that approach isn’t acceptable when it comes to putting vehicles on the streets.

I’d say the UK is at the forefront of clarity in describing autonomy.

///

German Digital Manufacturing Initiative

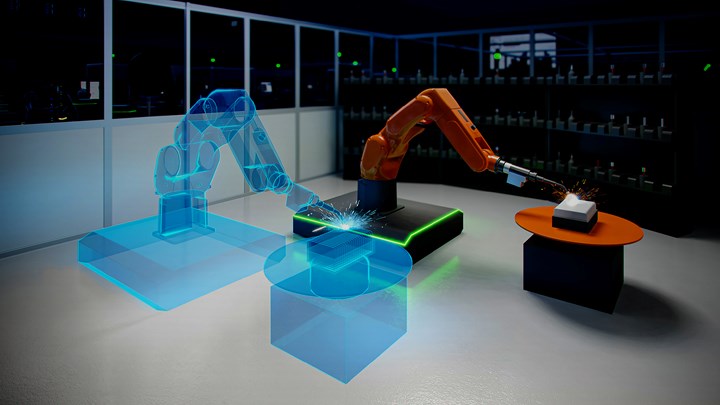

Digital twins are fundamental in a German project to improve manufacturing capability. (Image: Bosch)

Meanwhile, over in Germany, a group of companies and organizations led by Bosch, the University of Stuttgart and the Karlsruhe Institute of Technology—a group of 30 in all—is undertaking a research project being funded by the German Federal Ministry for Economic Affairs and Energy.

Funded to the tune of 35 million euros.

The project:

Which is more understandable (but much longer) in words:

Software-Defined Manufacturing for the Vehicle and Supplier Industry

A simple explanation is that they’re working to develop “adaptable manufacturing” capability.

Operationally Flexible

The issue being addressed is that because often equipment is built for a particular product and then the software written to drive that machinery to get the job done, transferring that software to other, different operations isn’t possible.

This means new product launches take longer than the group participants would like.

To vastly simplify things (i.e., in the description of SDM4FZI on its site it says things like: “The basic prerequisite is the abstraction of the existing hardware through digital twins with the help of which the software can be automatically derived and distributed”), they are creating prototypes of machinery and digital twins of same that are defined by software.

(Here’s a great definition of “digital twin” from the IBM Business Operations Blog:

“. . . creating a highly complex virtual model that is the exact counterpart (or twin) of a physical thing. The ‘thing’ could be a car, a building, a bridge, or a jet engine. Connected sensors on the physical asset collect data that can be mapped onto the virtual model. Anyone looking at the digital twin can now see crucial information about how the physical thing is doing out there in the real world.”)

So the digital twin will allow AI to analyze the machinery for purposes of efficiency and adaptability.

An objective is to develop a uniform framework that can be used in manufacturing to have the capacity to make changes quickly without major retooling downtime.

The goal: Get this done in three years.

///

Powertain Shift

Yes, the number of ICEs will decrease. But remember: hybrids use ICEs, so they’re down, not out. (Image: Cadillac)

Speaking of the need for flexibility, consider these stats from IHS Markit and recognize the implications they have for OEMs and suppliers when it comes to be able to produce various types of powertrains now and in the not-too-distant future:

US Light Vehicle Sales Share by Propulsion Type

2020 2025 2030

Battery electric: 1.9% 14.8% 34.1%

Fuel cell: 0.0% 0.0% 0.1%

Plug-in hybrid: 0.4% 4.7% 7.3%

Full hybrid: 2.9% 11.1% 11.0%

Mild hybrid: 2.3% 11.1% 10.6%

ICE + start/stop: 92.5% 60.1% 36.9%

Source: IHS Markit Sales-based Powertrain Forecast, H2, 2021

One thing not to lose sight of:

All of the hybrids, as well as the ICE with start/stop, have (or are) internal combustion engines. Which means that in 2030 there will be engines under the hoods of 65.8% of vehicles.

That said, the loss of 32.2% of the market in 10 years (i.e., the 2020 1.9% of BEVs going to 34.1%) is nothing to underestimate.

Companies involved in everything from casting blocks to machining pistons may find themselves in a challenging situation within just a few cycles.

///

Harsh

Although Tesla ranks #1 in the green rankings, Renault comes in #2, and let’s face it: Seeing Renault vehicles isn’t common in the U.S. This is hydrogen-powered commercial vehicle. (Image: Renault)

While on the subject of the transition to alternative vehicles. . .

Although global OEMs have increased the percentage of vehicle sales that are considered to be “low carbon,” according to research conducted by CDP, the World Benchmarking Alliance (WBA) and ADEME (it is a non-profit that “run’s the world’s environmental disclosure system for companies, cities, states and regions”; a benchmarking firm that ranks companies’ performance in the context of the United Nations Sustainable Development Goals; and the French Agency for Ecological Transition [whew!]), the number isn’t particularly high:

7%

However, given that it was 2% in 2015 that’s not horrible.

Yet the groups say that if the OEMs are going to be aligned with the Paris Agreement’s target of 1.5°C warming, 64% of their sales need to be low-carbon by 2030.

Some companies that you might think are doing a reasonably good job aren’t, the researchers say.

What they describe as “seven of the 30 most influential companies” had less than 1% of their sales in the low-carbon category in 2020:

- Ford

- Honda

- Mahindra & Mahindra

- Mazda

- Subaru

- Suzuki

- Toyota

More surprising, perhaps, are the 2021 rankings in the WBA Automotive Benchmark that assess “a company’s degree of alignment with the transition to a low-carbon world, in line with the 1.5°C Paris Agreement temperature goal.”

That Tesla is #1 isn’t a surprise—but that it scores 70.7 out of 100 is. That’s a considerable delta.

Renault, in second, is at a score of 61.9, and VW in third, is at 51.7. None of the remaining 27 companies top 50.

(OK, you’re probably wondering which company is in last place. It is Chery Holding Group. With a score of 4.8.)

///Importance of Experience

And if all of the foregoing isn’t enough to make you wonder about the industry, consider this from a just-published piece by McKinsey:

“There was a time in the not-too-distant past when car manufacturers competed largely on their engineering capabilities: superior driving performance and vehicle reliability. These qualities still matter to today’s consumers, but they are table stakes. The new battleground is increasingly one where tech-enabled, data-rich, electric vehicle (EV) companies currently have the upper hand: customer experience.”

The article, “The new key to automotive success: Put customer experience in the driver’s seat,” was written by four McKinseyites, all based in Germany, where the legacy OEMs have predicated their success on engineering capabilities and driving performance.

So while the Germans may be solid when it comes to the table stakes, let’s not forget that when it comes to things like customer experience, the U.S. producers may have the advantage.

After all: Disneyland wasn’t invented in Stuttgart.

RELATED CONTENT

-

On Electric Pickups, Flying Taxis, and Auto Industry Transformation

Ford goes for vertical integration, DENSO and Honeywell take to the skies, how suppliers feel about their customers, how vehicle customers feel about shopping, and insights from a software exec

-

On Military Trucks, Euro Car Sales, Mazda Drops and More

Did you know Mack is making military dump trucks from commercial vehicles or that Ford tied with Daimler in Euro vehicle sales or the Mazda6 is soon to be a thing of the past or Alexa can be more readily integrated or about Honda’s new EV strategy? All that and more are found here.

-

On Zeekr, the Price of EVs, and Lighting Design

About Zeekr, failure, the price of EVs, lighting design, and the exceedingly attractive Karma

.jpg;width=70;height=70;mode=crop)