on Rimac, Simulating Forming & Lots About Electrification

Mate Rimac is revolutionizing auto, Sandia is aiding metal formers, EV pickups may boost the U.S. market, cute German pickups, the Toyota RAV4’s massive shopping appeal, a forthcoming EV SUV entrant, and the innovativeness of auto

The Seriousness of Rimac

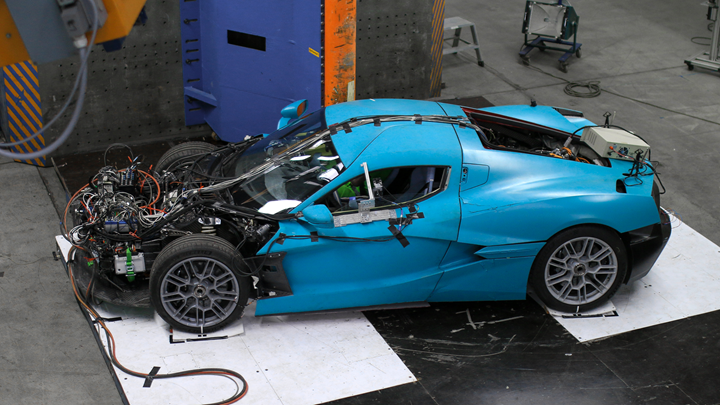

The Rimac Nevera: The testing model. (Image: Rimac)

Mate Rimac started the company that bears his surname in 2009. Mate Rimac was born in 1988 (February 12, so belated Happy Birthday!).

Rimac Automobili, which is based in his home country, Croatia, designs, engineers and builds electric vehicles.* Its first, the Concept One, was introduced at the 2011 Frankfurt Motor Show. At the time the 1,224-hp (913 kW) sportscar was said to be the fastest accelerating car available (0 to 62 mph in 2.5 seconds).

And speaking of availability, the Concept One, which was in production for just under two years, had a run of eight cars.

At this point you might be thinking, “So what? A niche EV builder. There are probably lots of them LA or Santa Clara county.”

True.

But consider this:

In November 2021 Rimac Automobili took control of Bugatti.

That’s right: the company established in 2009 took over the legendary company established 100 years earlier.

Before that happened, Porsche bought 22% of Rimac Automobili, Hyundai Group 11%, various other investors 32%. Mate Rimac holds 35%.

Now Rimac Group holds 55% of Bugati Rimac. . . .

Comprehensively Crashing

Which is a long way to getting to the contemporaneous point that the company has just concluded, after four years of testing, the crash testing protocols for global homologation of the electric Rimac Nevera.

The Nevera’s four motors propel the car from 0 to 62 mph in 1.97 seconds. Yes, the 1,914-hp (1,427-kW) vehicle is faster than the Concept One.

It is a study in carbon fiber, with the monocoque, roof and rear subframe, as well as other components, produced with the stiff and strong material: according to the company, the torsional rigidity of the Nevara is 70,000 Nm/degree. “Regular” supercars have a stiffness of 40,000 Nm/degree.

Both digital and physical crash tests were performed.

The engineers would run a digital simulation and, based on the results, make modifications to the physical model before subjecting it to testing.

While a physical crash test would take 80 milliseconds, even though they were using clusters of high-performance computers, it would take about 20 hours of processing time to get the precise simulation.

There were 45 physical tests run during the regimen.

The last physical test was a simulation of the Nevara having a side impact at 20 mph with a lamp post.

The crash energy management was so good that the door could be opened after the test.

How serious are they about the ~$2.4-million car?

Consider this: there will be just 150 built.

Certainly more than the Concept One, but that four years’ of testing couldn’t have been inexpensive.

*Fun fact: Nikola Tesla was born in Smiljan, Croatia

///

Machine Learning Comes to Sheet Metal

David Montes de Oca Zapiain, a researcher at Sandia National Laboratories, points out that manufacturers can spend months on screening materials like sheet metal for formability properties (to make sure that it isn’t going to crack)—and they’re using computer simulation.

As OEMs are seemingly all trying to reduce time-to-market, months can be long. Possibly too long.

However, there are, he admits, some high-fidelity computer simulations that can get the job done in a few weeks.

But that requires a supercomputer.

So Montes de Oca Zapiain and his colleagues, working with researchers at Ohio State University, have developed an algorithm that can do the analysis in less time, no supercomputer required.

That said, there is a need for an electron microscope.

And admittedly, the name of the machine-learning algorithm they’ve come up with is a bit. . .unusual:

MAD3

That’s for “Material Data Driven Design.”

Before you stop reading, here’s why you want to keep reading:

“You could efficiently use this algorithm to potentially find lighter materials with minimal resources without sacrificing safety or accuracy.”--Montes de Oca Zapiain

A brief explanation of how this works:

The aforementioned weeks’ long simulations tend to be based on mechanical tests of formability.

In the MAD3 approach, the fact that metal alloys are made of “crystallographic” grains that form a texture such that the metal is stronger in some directions than in others—a.k.a., “mechanical anisotropy”—is key.

Montes de Oca Zapiain: “We’ve trained the model to understand the relationship between crystallographic texture and anisotropic mechanical response.

“You need an electron microscope to get the texture of a metal, but then you can drop that information into the algorithm, and it predicts the data you need for the simulation software without performing any mechanical tests.”

The algorithm was trained with the results of 54,000 simulated materials tests. (This is where the Sandia personnel worked with those from Ohio State.)

Then 20,000 new microstructures were used to test the accuracy of the system. Comparisons were made with data from experiments and supercomputer-based simulations.

How Does It Perform?

“The developed algorithm is about 1,000 times faster compared to high-fidelity simulations,” said Sandia scientist Hojun Lim. “ We are actively working on improving the model by incorporating advanced features to capture the evolution of the anisotropy since that is necessary to accurately predict the fracture limits of the material.”

Although MAD3 is said to have applicability to automotive, let’s face it: Sandia is a national security lab. Its interest in the algorithm goes to the quality assurance program for the U.S. nuclear stockpile.

///

Bit of a Shock

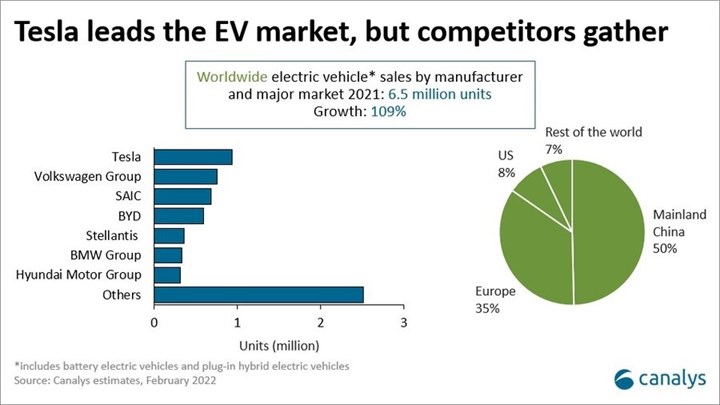

What’s interesting on this is the lower left: “Others.” There are a lot of vehicles being sold by that unidentified group. Odds are good that many of those companies are based in China, where there is an estimated 300 EV firms. (Chart: Canalys)

“Over 3.2 million EVs were sold in Mainland China in 2021—half of all electric cars sold worldwide, and 2 million more than were sold in the country in 2020.”

That’s Jason Low, Principal Analyst at Canalys.

He adds:

“15% of new cars sold in 2021 in Mainland China were EVs – more than double the percentage in 2020, and there is still a huge opportunity for future growth in 2022 and beyond.”

The word yikes comes to mind.

The Canalys numbers include plug-in hybrids, so it isn’t all fully battery electric.

Still. . . .

Meanwhile, over in Europe, things were going well in that space: sales of 2.3-million EVs. Or 19% of all new cars.

In the U.S.?

Approximately 535,000 units, or 4%.

Heavy Lifting

On the subject of the U.S. and EV sales, Chris Jones, vp and Chief Analyst at Canalys, notes:

“The competition’s EV sales are nowhere near Tesla’s in the U.S. since Model 3 shipments ramped up in 2018. Tesla even outsells many premium car brands in the overall market.”

All of those “Tesla fighters” that have been launched seem to be punching below their weight.

However. . .

“Pick-up trucks will give the U.S. EV market a huge lift in 2022,” Jones says.

The word yup comes to mind.

///

Diminutive German Pickups

German electric quadracycles based on the XBUS platform. (Image: Electric Brands)

Speaking of pickups. . .

A German company, Electric Brands, is developing two electric vehicles on its XBUS platform, the PICKUP and the PICKUP bus.

The primary differences between the two vehicles:

The PICKUP has an open loading area in the back while the PICKUP BUS features a driver’s cab, a rear cab and an open loading area.

However. . .

These vehicles fall under the European Union L7e category. “Heavy Quadricycle.”

Which means not full-blown motor vehicle.

The PICKUP is 155 inches long, 66.5 inches wide and 78 inches high.

Comparo

So by way of comparison, let’s take the Ford Maverick. (Because it is small and the comparison with an F-150 Lightning would be ridiculous. While the Maverick isn’t an EV, it does come standard as a hybrid.)

It is 199.7 inches long, 77.9 inches wide (mirrors folded) and 68.7 inches high.

In other words, almost enormous compared to the German vehicles.

Odds are, the PICKUP won’t be coming to the U.S. anytime soon.

///

Electrified Vehicles: They Really Like Them

2022 Toyota RAV4 Hybrid: An exceedingly popular hybrid. (Image: Toyota)

And while full EVs may have a long way to go in the U.S., hybrids, on the other hand. . .

U.S. consumers are becoming increasingly interested in vehicles that are electrified.

Or so data in the recently released Q4 2021 “Kelley Blue Book Brand Watch” report indicates.

The study measures shopping data.

Notably, in the top-five of SUVs, the Toyota RAV4 Hybrid enters at number three—just behind the standard, non-hybrid RAV4, which sits at number two. (The Honda CR-V is in first place.)

In addition, the RAV4 Hybrid has entered the top 10 list of models considered, at number seven.

The whole list:

- Ford F-150

- Chevrolet Silverado 1500

- Honda CR-V

- Toyota RAV4

- Toyota Tacoma

- Ford F-250/F-350/F-450

- Toyota RAV4 Hybrid

- Subaru Forrester

- Subaru Outback

- Jeep Grand Cherokee

From the overall examination of non-luxury vehicles, Ford has bested Toyota in brand consideration for Q4 (33% vs. 32%), which Michelle Krebs, executive analyst at Cox Automotive, attributes, in part, to the F-150 hybrid, F-150 Lightning BEV, the Mustang Mach-E BEV, and the Maverick, which comes standard as a hybrid.

The study shows that 28% of shoppers are interested in electrified vehicles, a new high.

In terms of the top 10 in the electrified segment, the vehicles are:

- Toyota RAV4 Hybrid

- Tesla Model 3

- Tesla Model Y

- Honda CR-V Hybrid

- Ford Maverick Hybrid

- Ford Mustang Mach-E

- Toyota Highlander Hybrid

- Volkswagen ID.4

- Ford F-150 Lightning

- Ford F-150 Hybrid

With more than a quarter of the interested vehicle-shopping public interested in electrified vehicles, clearly this is not entirely something that is driven by regulations.

///

Who Needs an EV?

The Mullen FIVE EV SUV. Not going into serial production for a couple of years. (Image: Mullen)

That said, there is something curious here. . .

SoCal EV startup company Mullen says it is on track to deliver its first vehicles in Q2 ’22. . . cargo vans.

There are both Class 1 and Class 2 vehicles, with the former offering 210 cubic feet of cargo area and a 160-mile range and the latter a 460-cubic-foot cargo capacity and a >200-mile range. They are being assembled in the Mullen 120,000-square-foot Advanced Manufacturing Engineering Center in Tunica, Mississippi.

The FIVE

Of course, there is another vehicle being developed, the Mullen FIVE. This is an electric SUV that is supposed to be in “fully functional and drivable” form by Q3 ’22. The vehicle will offer a range of ~325 miles and a cargo capacity of 71 cubic feet. Starting price is $55,000. Deliveries are estimated to begin in Q2 ’24.

Mullen, in part because it is interested in securing a loan for $450-million from the Department of Energy Advanced Technology Vehicles Manufacturing Loan Program (ATVM), authorized by the Energy Independence and Security Act of 2007, ran a survey among some 4,000 people, 18+ with a household income of $50,000+

And in the survey it asked to compare the FIVE against the Ford Mustang Mach-E and Tesla Model Y.

In a “concept benchmark test” between the three vehicles, with the categories “Purchase Consideration,” “Degree of Appeal” and “Need Fulfillment,” the vehicles had the respective scores:

- Model Y: 50%, 61%, 44%

- FIVE: 43%, 58%, 41%

- Mach-E: 44%, 54%, 40%

The Mullen people are chuffed at how well they scored overall, especially in comparison with the Mach-E.

Of course, the Model Y and the Mach-E are “real” cars, so there’s a better sense of them than the FIVE prototype shown at the 2021 LA Auto Show.

But one thing is also striking: None of the vehicles do particularly well in that “Need Fulfillment” category. Which possibly means that even though they are all “utility” vehicles, it is a matter of want, not need.

///

Auto Innovates

One of the things automation and electrification are doing to the auto industry is amping up its levels of innovation.

That’s a conclusion based on the “Top 100 Global Innovators 2022,” a report released yesterday by Clarivate, a UK-based firm that provides “trusted information and insights to accelerate the pace of innovation.”

(Should you be doing an eye-roll about that, know that the company’s board of directors announced earlier this month that it is undertaking a buyback of its shares up to $1-billion, so there is clearly some money there, meaning they evidently know what they are doing.)

The company determined that while there were six auto (OEM and supplier) companies making the list in 2021, that number is now 12.

On the list are:

- Ford

- General Motors

- Honda

- Hyundai

- Kia

- Toyota

- Volkswagen

- Continental

- Denso

- Michelin

- Valeo

- Yazaki

Another interesting aspect of Automotive’s performance on the list:

Of the 15 industry categories (from Aerospace and Defense to Telecommunications), only Electronics and Computing Equipment had a greater number of innovative companies.

Seems like auto is an excellent place for smart people, particularly the young(er) ones who are driven to innovate.

RELATED CONTENT

-

How to Keep a Last-gen Truck Current

In order to keep the Classic of interest, Ram Truck has gone back to 1976, the year they launched the Dodge Warlock, a “factory-personalized” pickup, and have created the 2019 Ram 1500 Classic Warlock.

-

Cobots: 14 Things You Need to Know

What jobs do cobots do well? How is a cobot programmed? What’s the ROI? We asked these questions and more to four of the leading suppliers of cobots.

-

On Zeekr, the Price of EVs, and Lighting Design

About Zeekr, failure, the price of EVs, lighting design, and the exceedingly attractive Karma