B2B Research: A Powerful Marketing Tool

The Gardner Business Media Industrial Buying Influence 2020 study findings can be used as a powerful marketing tool. The study provides demographic and psychographic details that help you better understand customers and prospects. We know knowledge is power and knowing how B2B industrial buying dynamics are changing is a key to successfully empowering your marketing.

#brandbuilding #leadgeneration

Gardner’s Industrial Buying Influence 2020 Can Help Sharpen Your Game

By Mark Semmelmayer, CBC

Chief Idea Officer

Pen & Inc. Marketing Communications

First published in 2011 as Media Usage in Manufacturing, Gardner Intelligence’s Industrial Buying Influence series examines how media and marketing impact industrial buying. The 2020 survey, the fifth in the series, focused on the industrial buying team. The process with which buying teams evaluate, research, and decide on purchases, and how media and marketing influence each stage of that process.

Since 2015, it’s been my honor, at Gardner’s request, to summarize key survey findings in a digestible, big picture nugget. Suggesting practical insights to making you, as a B2B marketer, better focused and more successful. I can’t summarize the entire survey, but it’s full of relevant information. Read it all here: https://collections.gardnerweb.com/ibi

A full read can give more context than I can provide in a short format. But, we’re all busy, so here’s my CliffsNotes® version.

Methodology:

|

Respondents: |

884 Industrial Manufacturing Professionals, via mail, email or phone |

|

Demographics: |

Respondents represented a cross section of manufacturing companies: varying industries, sizes, and revenues |

|

Focus: |

Respondents were instructed to consider their purchase process when addressing survey questions |

Macro Takeaway:

There’s a youth movement afoot. Past Gardner research indicated younger buyers & influencers were beginning to take seats at the table. In 2015, the trend was a babbling brook. It’s becoming a steady stream. Now, 61% of buying team members are age 40-51.

The implications for B2B marketers are clear. As age ranges of buyers and influencers shift, so do their media consumption preferences. With a nod to Marshall McLuhan, medium and message are probably more strongly linked than ever. I think there are three distinct age groups involved in the process, with different media “habits,” defined in my terms as:

|

Digital Copers: |

>50, whose corporate lives started before widespread digital technology |

|

Digital Adopters: |

40-50, for whom digital tools were part of their career almost from the start |

|

Digital Natives: |

<40, born with a smart phone in their hands |

Look around your own organization. You’ll probably see more than a grain of truth here. Research has shown, in the population at large, each of these groups gather, evaluate and process information in different ways. And, that’s the big point.

What Does Today’s Buying Dynamic Look Like?

Since inception, the report’s detailed the makeup of buying teams. Not surprisingly, it’s changing. To a fair extent, the buying team, and the roles of its members, vary with the size of the enterprise. But small or large, the basic process is constant:

Discovery→Research→Evaluation→Decision

Buyers are always evaluating, but there are two purchase triggers; need and opportunity. NEED: “Machine A breaks down regularly. We need a new one.” OPPORTUNITY: “If we can get Machine A to talk to Machine B…and to shipping…we can do it better, faster and cheaper.”

The composition of industrial buying teams mandates solutions-focused marketing strategies, that are content-based and integrated across channels. Regardless of facility size or purchase type, typical buying cycles require over 3 months and require:

• More than 4 people

• Multiple vendors

• Specific business need

Parsing Today’s Buying Team

Title

Manager (74%) is the most common title influencing all buying cycle stages

Age

41-50 (61%) is the most common age range represented on the industrial buying team

Smaller Facilities

- Likely to have sole decision maker

- Likely to rely on magazines and vendor websites

- Likely more motivated by service and cost

Larger Facilities

- Largest average buying team (4+ participants)

- Likely to buy on project basis, less motivated by service and cost

- More likely to have younger (21-30) buying team members

Next Gen Buyers

- Likely to be involved in discovery/research phases

- Likely to use video in the buying process

- Rely more on trade media websites and content marketing

Integrated Marketing Is Key

90% of industrial buyers use a minimum of 3 different media “types” to make their decision. They’re most influenced by trusted information sources and known, trusted brands. While this may shift over time, respondents cited magazines and websites as 3X more influential in vendor evaluation and selection than non-industry sources like search and social. The top 5 information sources cited were:

- Supplier Websites

- Online Search

- Industry Websites

- Trade Events

- Trade Magazines

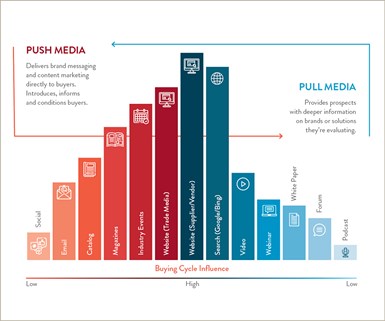

While this hierarchy is dominated by “Push” media, “Pull” media, like Online Search begins to show a shift in buyer habits. To be on the same page, here’s an overview of “Push” and “Pull”:

Push

- Trade Media Magazines

- Industry Events

- Catalog

- Social Media

Pull

- Website (Supplier, Industry, Trade Media)

- Search (Google/Bing)

- Video

- Webinar

- White Paper

- Podcasts

The need for an integrated marketing communications strategy is rooted in the digital psyche of individual buying team members, and how they gather trusted information. Younger team members lean to “Pull” media, older to “Push”. Those in between are a hybrid. Bottom line, you need both to be effective.

Parting Thoughts

Brand and the Buying Cycle

The foundation of successful industrial marketing is continuous brand development. Your brand is not your product, it’s what your product represents in your buyer’s mind. A product solves their problem. A brand is the one they feel solves it best. Contextual display advertising and content marketing are leading influencers in developing awareness and brand.

It Is About Brand

Buyers purchase based on need or opportunity — nearly 97% of decision processes involve the evaluation of at least one alternative vendor. There’s opportunity to grow your market share if your brand is known and present across channels.

Need more information?

Mark Semmelmayer, CBC

Chief Idea Officer

Pen & Inc. Marketing Communications

Saint Simons Island, Georgia

770-354-4737

LinkedIn

About the Author

Mark Semmelmayer, CBC

Mark is a past international chairman of the Business Marketing Association (BMA), the 2015 recipient of BMA’s prestigious G. D. Crain Award and an Inductee into the Business Marketing Hall of Fame. A 40-year B2B marketing pro, including 32 years with Kimberly-Clark, he’s the founder and Chief Idea Officer of Pen & Inc. Marketing Communications, a consultancy in Saint Simons Island, GA.

RELATED CONTENT

-

Embracing Career Change

After 16.3 years, Derek Korn had become Modern Machine Shop’s Executive Editor, Technical Director of the brand’s Top Shops benchmarking program and creator of the annual Editors’ Walking Club. His plan was to continue with the magazine until retirement. But the editor-in-chief of sister publication Production Machining announced that he was retiring. The company asked if Derek would be open to moving to Production Machining. For him, it was a matter of choosing comfort with a brand he was familiar with or changing to lead a new one. He not only chose to change, but to embrace it.

-

Marketing Mistakes Could Be Fatal to Manufacturing Companies

Although the economic fallout of the COVID-19 pandemic is hitting service and travel industries the hardest, B2B manufacturers and industrial companies are not immune. And just as human patients with underlying issues are more susceptible to the pandemic, so are B2B companies with underlying financial, organizational and marketing issues. It’s time to acknowledge the marketing issues you have and get in front of them. Turn underlying B2B marketing problems into bonafide marketing differentiators. Here are four underlying marketing issues that could prove catastrophic to B2B manufacturers.

-

Gardner’s Industry Buying Influence Study 2022: Behavioral Considerations for Marketers

Planning with an eye toward current buyer behavior is key to keeping current and enhancing opportunities for success.