BMW Plots Post-Coronavirus Growth

$32 billion earmarked for advanced r&d over next five years

BMW Group’s profits before taxes fell 27% last year to €7.1 billion ($7.6 billion). The company expects profits to be “significantly lower” this year—possibly by as much as 50%—due to the effects of the coronavirus.

Chairman Oliver Zipse with the upcoming i4 EV

The carmaker, which has suspended production at several of its manufacturing plants for the next month, acknowledges that it’s too soon to forecast what the full impact on vehicle sales and earnings will be for the rest of 2020.

But that hasn’t stopped it from planning for future growth.

Electrifying R&D

At BMW’s annual investors meeting this week, Chairman Oliver Zipse announced the company will invest more than €30 billion ($32 billion) in research and development through 2025.

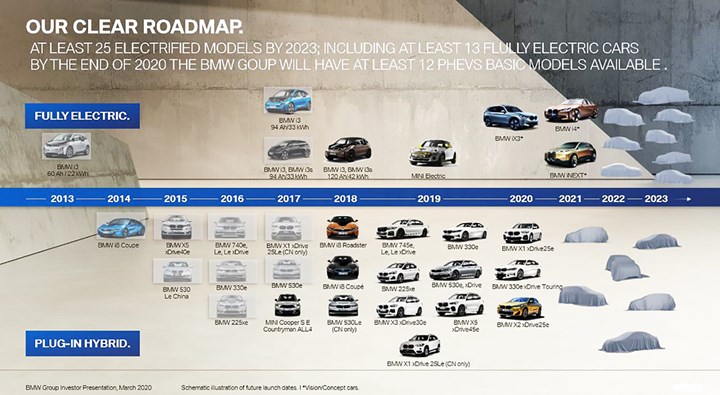

Much of the total will go toward electrifying future BMW and Mini small car models. The company previously has said the brands will launch a combined 25 electrified vehicles by 2023.

BMW aims to have a quarter of its new vehicle fleet electrified by 2021, with more than one million all-electric or plug-in hybrid drivetrains on the roads by that time. The ratio is due to grow to one-third by 2025 and top 50% by 2030.

At the same time, the number of conventional piston-powered drivetrain variants will be cut in half by the end of 2021.

7 Series EV Coming

Currently, the carmaker’s EV lineup includes the BMW i3 city car and Mini Cooper SE. The iX3 crossover is due later this year, with the i4 sport sedan and flagship iNext crossover to follow in 2021.

BMW also confirmed that the next-generation 7 Series sedan will add an all-electric variant to its current mix of gasoline, diesel and plug-in hybrid options. The latter was launched last year.

The carmaker’s Rolls-Royce marque also plans to eventually offer an EV. But hybrids won’t be an option for the ultra-luxury brand.

Cost Reductions

Company officials say BMW also is moving forward with its cost reduction initiatives, including plans to slash at least €12 billion ($13.3 billion) by 2022.

In addition to working with suppliers to lower the cost of materials and indirect purchasing, BMW is working to streamline the product development process. By using more digital development tools and employing leaner structures, the carmaker aims to cut vehicle development times by as much as one-third.

Coronavirus Response

In terms of the coronavirus, Zipse calls for solidarity and responsible action to minimize the spread of the disease and protecting the health of workers. BMW plans to continue to adjust production volumes and enhance manufacturing flexibility to respond rapidly to changing market demands.

“One thing is certain: Coronavirus is here now, but there will also be a time after coronavirus,” Zipse notes. “The approach we are taking clearly reflects the BMW Group’s ability to react quickly and flexibly.”

RELATED CONTENT

-

We Can’t Unwatch this McLaren

While we generally can’t say enough (which brings us close to saying much, much too much) about McLaren Automotive design and its exquisite use of materials, this week the company launched a product that is something we wish we didn’t see: That’s the RM 11-03 McLaren Automatic Flyback Chronograph, which the company debuted at the 88th Geneva International Motor Show.

-

Choosing the Right Fasteners for Automotive

PennEngineering makes hundreds of different fasteners for the automotive industry with standard and custom products as well as automated assembly solutions. Discover how they’re used and how to select the right one. (Sponsored Content)

-

Cobots: 14 Things You Need to Know

What jobs do cobots do well? How is a cobot programmed? What’s the ROI? We asked these questions and more to four of the leading suppliers of cobots.