on Business Transformations, Environmental Developments & Propulsion Issues

Volvo Group looks ahead, a sustainable seat, navi tech concern, upfitting for electrification, EVs and employment, Ford reorganizes, gas prices and vehicle sales

A Look Forward to 2030 & Effects on Your Business

Volvo Group makes, among other things, serious gear like this EC 550 Hammer. (Image:Volvo Group)

Volvo Group is not the Volvo that makes SUVs and sedans.

Rather it makes commercial trucks, construction equipment, buses and the like.

Serious equipment.

Last week the Sweden-based company released its annual and sustainability report covering 2021.

It did well compared to 2020, with net sales of SEK 372 billion up from SEK 338 billion, net operating income of SEK 41 billion compared to SEK 28 billion and an adjusted operating margin of 11% compared with 8.4%.

But that’s not what this is about.

Rather, some suppositions that the company makes are worth noting as they are also applicable to companies that make things other than Class 8 trucks, etc.

The Road Ahead

Looking forward to 2030, Volvo Group thinks these factors are going to drive change:

- 30% of all European vehicle sales are expected to be electric

- 8.6 billion people share the planet, with 70% living in cities

- 4 out of 5 economic superpowers are found in Asia, with China the world’s largest economy

- 90% of all people have access to the internet

- Effects from climate change are clearly visible

- Consumer power is increasing and consumers are getting used to seamless and customized solutions in digital channels

What does this mean for business (and remember that this is a company that make things including construction equipment)?

- Increased demand for transport and infrastructure solutions

- Being sustainable is a must

- An increasing number of consumers prefer utilizing services as opposed to owning products

- Companies owning customer interfaces and relevant data thrive as they can provide seamless and individualized services and products

- More power resides with the buyer. B2B (business-to-business) and B2C (business-to-consumer) have merged into B2P (business to people)

The third and fourth items on the implications list (services rather than ownership; owning interfaces for tailored products and services) are something to think about.

Hard.

Let’s face it: 2030 isn’t that long from now.

///

Quick Quiz

The Wuling 280T multipurpose vehicle was introduced in Shanghai on February 22. It is not the answer to the quiz. (Image: GM)

In January (yes, it is March, but it takes time for the data to be compiled) passenger vehicle sales in China were up 5.4% year-over-year to 2.24-million units. That according to LMC Automotive.

So here’s the quiz bit:

Which company had both the best sales (228,728 vehicles) and highest production (222,755) in China this past January?

The answer can be found at the very bottom of this page.

(Otherwise, it wouldn’t be much fun, would it?)

///

Sustainable Seat

The Transys seat is made largely with sustainable materials. And evidently for autonomous vehicles, too. (Image: Hyundai Transys)

At the end of December, Hyundai Motor Company reportedly shifted the engineering personnel who were working on internal combustion engines over to electric powertrain development.

Arguably, they could see the writing on the whiteboard.

There are other companies under the Hyundai Motor Group umbrella. Including Hyundai Transys, a parts supplier.

Also Going Green

Just as the vehicle building part of the organization sees the switch toward more environmentally oriented approaches, so, too, Hyundai Transys.

The company has developed a seating concept that focuses on sustainability. And it also is configured such that it lends itself to applications in autonomous mobility.

To produce the seat with materials that include leather from tanning waste, Hyundai Transys worked with Italian (Dani S.P.A., Manifattura di Domodossola and Dyloan) and Korean (Dual and ATKO Planning) suppliers.

There is tanned leather in areas where durability is required. For the bolsters, woven leather is used, which helps address leather waste from cutting.

A Lot of Yarn

Leather scraps are ground to powder, then woven into yarn. That yarn, in turn, is woven with yarn created from recycled PET bottles. The result is a fabric for the floor.

Regenerated aluminum powder is used to produce the 3D-printed headrests. Upcycled felt fabric is also used.

Sung-kyung Hong, Design Team Leader at Hyundai Transys:

“When autonomous driving mobility spaces become everyday places in our lives, material research and development from the eco-friendly perspective shown in this concept seat will become more important for the future of mobility.”

///

Quick Routing

Last summer I happened to be driving from Lansing, Michigan, to Milford, Michigan, using a popular navigation app. It routed me through a roadway in the parking lot of a large shopping complex. Which, I determined after getting out of the obstacle course of people, shopping carts and other vehicles, and considered where I started, where I went and where I ended up, wasn’t exactly sensible.

But who really knows? You put in the end point and the system calculates.

A study published in Transportation Research Part C, “Navigating to safety: Necessity, requirement, and barriers to considering safety in route finding” by researchers from Texas A&M, made me feel a bit better about my vexing adventure. It could have been worse.

Researchers Dominique Lord and Soheil Sohrabi write:

“Although recent versions of automotive navigation systems help users minimize their travel time, there are certain situations in which the shortest route is not necessarily the safest one.”

They assessed routing in five Texas metro areas with the objective of determining how safe the recommended routing is. The assessment included more than 29,000 road segments.

And the researchers determined: “The results of comparing the safest and shortest route between pairs of origins and destinations showed that the shortest route can differ from the safest, where taking a route to decrease travel time by 8% was associated with a 23% higher risk of being involved in a crash.”

But you get there faster.

///

Upcycling for Refuse Vehicles

If going electric is an environmental play, then why not go electric in what had been diesel-powered up upgraded to the latest tech? (Image: Lunaz)

As there is a transition to electric commercial vehicles, it seems as though the approach is for new vehicles.

A British firm has another idea.

It calls it “upcycling.”

As David Lorenz, founder of Lunaz, explains the approach:

“By upcycling and electrifying industrial vehicles at scale, millions of tonnes of embedded carbon is saved by dramatically extending the usable life of thousands of vehicles that would otherwise be scrapped. By applying this approach to public sector vehicles like refuse trucks we deliver a result that is better for the taxpayer and better for the planet.”

To achieve that scale it is in the process of developing a manufacturing footprint of 210,000 square feet at the Silverstone Technology Cluster in England.

Bare Metal to State-of-the-Art

The approach starts with bare-metal restoration. The initial type of vehicle that the company is working on are refuse trucks. It is completely redone, including the addition of cameras, UX improvements, telematics and other gear.

The diesel powertrain is replaced with a proprietary electric powertrain that the company has developed.

The first truck that has undergone the upcycling is based on a Mercedes-Benz Econic platform, which is said to be one of the most widely used platform for industrial/commercial applications.

The company says that it will “deliver a fully upcycled, re-engineered refuse truck built to a near zero-mile standard. . .for broadly the same price as a new diesel equivalent and considerably less expensively than a new electric-powered refuse truck.”

///

Tool Trifecta

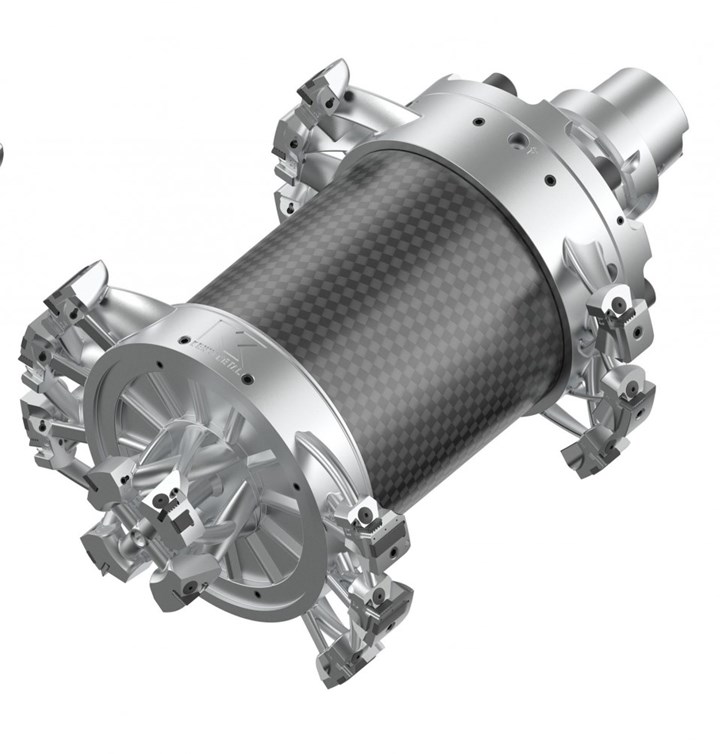

Tool combines carbon fiber (that central portion, obviously) and 3D printed components (those arms sticking out of the cylinder). (Image: Kennametal)

(1) It has 3D printing. (2) It has carbon fiber. (3) It is designed for electric motors.

It is a tool from Kennametal for machining stator bores—three diameters simultaneously—in aluminum engine housings for electric vehicles.

The tool has airfoil shaped arms that accommodate reaming tools and provide through-hole coolant. These arms are made with additive manufacturing because it was determined it would be “difficult or impossible to economically produce [them] with traditional manufacturing.”

The lightweight arms are said to permit the tool to achieve a fast spin-up.

And on the lightweight subject, the tool weighs 7.3 kg thanks in large part to the carbon fiber body.

This is the third generation of the tool design. The first-gen tool weighed 9.5 kg. Through improvements in design they were able to achieve the mass reduction.

And There’s This

Even if you have absolutely no interest in machining metal you have to admit that it really looks cool.

///

Thermal Engines & Employment

Don’t get Zipse wrong: BMW does make EVs, too. (Image: BMW)

Last month, BMW CEO Oliver Zipse (who is also the president of the European Automobile Manufacturers’ Association) reportedly said during a closed-door meeting in the German Bundestag, “The largest market segment in absolute terms by a wide margin in Germany, but also in Europe and worldwide, is the internal combustion engine. Before you simply shut something like that down within eight or ten years, you have to know well what you’re doing.”

In Addition. . .

According to a study from CLEPA, the European Association of Automotive Suppliers, released last December, if internal combustion engines are phased out in Europe by 2035, 501,000 supplier jobs will be lost. Of the total, 70%, or 359,000, will occur between 2030 and 2035.

CLEPA finds that there could be 226,000 new jobs in EV powertrain production created in the EU—if there is robust EU battery building (which does seem to be developing). . . but then the other shoe drops:

That is a net loss of 275,000 jobs in the sector from now until 2040.

Engine Drops

According to European consultancy Inovev, in Europe Germany is the leading producer of vehicles with what it calls “thermal” engines. (Think: ICEs)

In 2020 German companies produced 3,376,962 thermally powered vehicles.

In 2021 that number was 2,827,641, or a 16% decrease.

It could be argued that that had more to do with COVID and the chip crisis than battery electric vehicles. (Although in 2021 German companies produced 236,596 BEVs, or an increase of 91% over 2020 output.)

But let’s look at production in the #2 builder in Europe, Spain.

In 2020 2,212,714 vehicles with thermal engines were produced in Spain. In 2021 that output dropped by 8% to 2,044,578. That’s, percentage-wise, half of the drop in Germany.

Spain also had to deal with COVID and the chip crisis.

Another interesting set of numbers.

In 2020 German companies produced 1,164,248 more thermally powered vehicles than Spain.

In 2021 the difference was down to 783,063.

A Global Issue

The point is, whether it is in Europe, Asia (last September Akio Toyoda said at a meeting of the Japan Automobile Manufacturers Association that a shift to all EVs by 2030 “could risk the majority of 5.5 million jobs”) or the U.S., the impact of a transition to electric vehicles on jobs needs to be taken into account.

Although it seems as though there is an inevitability to the transition, although not to go in that direction could arguably be taking the road to a dead end, although there will be new jobs created, making the switch is not going to occur without some notable employment displacement.

///

Ford Does a Re-org

Ford CEO—and president of the new Ford Model e organization—Jim Farley. (Image: Ford)

Speaking of thermal engines and otherwise. . .

“We are going to continue to invest in internal combustion engines,” said Jim Farley, Ford CEO, on Wednesday in relation to his announcement of the reorganization of vehicle businesses at Ford with the creation of “Ford Blue” and “Ford Model e.”

The former has the internal combustion engine vehicle portfolio.

The later is the company’s electric vehicle, digital services and advanced technology operation.

Farley, who called the undertaking, “one of the biggest changes in our history,” emphasized the objective is to provide the means for people in the organizations to be able to focus, to specialize.

Why No Spin?

He also explained that the reason that they didn’t spin off Model e (which he is serving as president of, in addition to his CEO position) is because they want to achieve synergies between the two operations, with Ford Blue (headed by Kumar Galhotra) contributing to scale—particularly valuable vis-à-vis the sourcing of things like sheet metal, glass, seats, etc. (items enumerated by Lisa Drake, vp, EV Industrialization, Ford Model e). When you’re producing some two-million vehicles per year, you get scale for things that vehicles need, regardless of the propulsion system.

“Leverage”—Farley said in the context of the two operations working back and forth with one another—“is the key point” of maintaining the two under the same umbrella. He also pointed out they don’t need outside capital to fund this transformation (and outside capital is the lifeblood of startups).

Speaking of startups (a.k.a., all of those companies entering the EV space), Farley also made it clear that they are going to be taking it to them—as well as to the traditional OEMs.

However. . .

Farley and his colleagues, including CFO John Lawler, emphasized the spend that is being made by Ford on EVs: $5-billion in 2022, twice the spend of 2021.

Meanwhile, on the Ford Blue side of things, the talk is about cost reduction: Galhotra is tasked with cutting $3-billion over the next two to three years. (How? By doing everything from reducing the advertising spend to reducing warranty costs. “We are making a major attack on structural cost.)

Lawler: “Ford Blue is all about lean.”

He also said the company is working to achieve an EBIT margin of 10% by 2026; it was 7.3% in 2021.

Seems like Ford Blue is going to have a lot of heavy lifting to do in the next few years as Model e tries to find its footing.

Consider:

In the first two months of ‘22, Ford delivered 4,371 Mustang Mach-E battery electric vehicles.

It delivered 5,340 of the completely non-iconic EcoSport, which will be discounted this year.

Ford has 10,000 orders for the E-Transit. In the first two months it sold 9,475 Transits.

Yes, it is wise to invest in the future.

But Farley and his colleagues certainly have to keep what’s getting them there in mind.

///

Composite Good for the World’s Oceans

Start with fishing nets. Finish with auto parts. (Image: Avient)

They’re called “ghost nets” and there is anywhere from 500,000 to one million tons of these lost or discarded fishing nets in the ocean.

Some estimates have it that ghost nets account for 46% of the Great Pacific Garbage Patch. . .a floating collection of trash that, according to Smithsonian Magazine, “covers an estimated 1.6 million square kilometers—roughly three times the size of France—and currently floats between Hawaiʻi and California.” Or about twice the size of Texas.

Efforts are underway to remove this plastic trash from the oceans (as well as keeping more from getting into it in the first place).

So what do you do with some of this material?

Material company Avient has developed long-fiber reinforced composites, Complēt R, which makes use of nylon 6 material reclaimed from end-of-life fishing nets.

The company says that the Complēt R nylon 6 long fiber composites provide the stiffness, strength and toughness characteristic of those made with virgin resin.

Consequently, the material could be a drop-in replacement in applications where conventional long-fiber nylon 6 composites are used.

While those in the auto industry tend to be a bit hesitant when it comes to new materials, we asked Avient about auto applications.

And the people there acknowledged that while Complēt R hasn’t been through all of the testing automotive likes to see, they’re ready to perform “that testing and accelerate as needed for interested automotive customers.”

According to Eric Wollan, Avient general manager for Long Fiber Technologies, “Historically, it has been a challenge to source streams of recycled resins that are compatible with the pultrusion process used to manufacture long fiber composites”

Clearly, that is no longer a problem.

///

Will the Past Be Prologue?

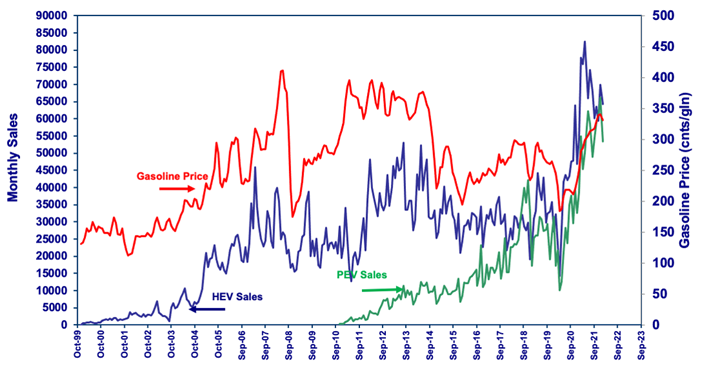

The blue HEV line is for regular hybrids, like the Toyota Prius. The green PEV line is for plug-ins, hybrids or full battery electric. (Image: Argonne National Laboratory)

Although that graph is rather jittery, it is something that we are likely to begin to see more of in the days and weeks ahead.

Why?

Because of the increase in gasoline prices that is likely to become inexorable.

There were price rises of late for the simple reason that compared to 2021 more people are getting on the road, which makes that whole supply-and-demand thing kick in. And just like the troubles that your local grocery store has in terms of finding people, the petroleum industry is not immune to employment challenges to say nothing of logistical snafus.

Due to the outrage being perpetuated in Ukraine, BP and Shell are pulling their business from Russia* and other knock-on effects of the invasion, there will be a reduction in petroleum (i.e., according to the U.S. Energy Information Administration, Russian is the third-largest oil producer, behind the U.S. and Saudi Arabia, accounting for 11% of the world’s oil).

Again, it doesn’t take Adam Smith to know the consequences of that.

Earlier This Century

Here’s something to think about.

According to Statista, in 2007 there were 8.5-million light trucks sold in the U.S.

In 2009—due to the financial collapse and quite possibly the fact that at the end of June 2008 the average price of gas in the U.S. hit a then-breathtakingly high $4.14 per gallon—light truck sales were down to 5 million.

It wasn’t until 2014 when the sales hit 8.7 million.

What’s Next?

Let’s assume the red line on that chart above ascends.

What happens to that light truck market?

Yes, there will be things like the F-150 Lightning and the Silverado EV, but will there be sufficient volumes to offset probable declines in ICE vehicles?

===

*While some people have looked askance at the genuine level of social engagement of some big corporations in general and petroleum companies in particular, these words from bp chair Helge Lund should go a long way to mitigating that:

“Russia’s attack on Ukraine is an act of aggression which is having tragic consequences across the region. bp has operated in Russia for over 30 years, working with brilliant Russian colleagues. However, this military action represents a fundamental change. It has led the bp board to conclude, after a thorough process, that our involvement with Rosneft, a state-owned enterprise, simply cannot continue. We can no longer support bp representatives holding a role on the Rosneft board. The Rosneft holding is no longer aligned with bp’s business and strategy and it is now the board’s decision to exit bp’s shareholding in Rosneft. The bp board believes these decisions are in the best long-term interests of all our shareholders.”

That is a $25-billion decision.

///

Quick Quiz Answer

(Image: VW)

Answer: Volkswagen. What’s more, its Lavida was the best-selling model, 45,524 units. (To put the car in context, it is analogous to the Jetta in the U.S. market.)

RELATED CONTENT

-

Rage Against the Machine

There have been more than 20 reported attacks against Waymo’s self-driving fleet in Chandler, Ariz., since the company began testing the technology on public roads there two years ago.

-

On the Genesis GV80, Acura MDX, BMW iDrive and more

From Genesis to Lamborghini, from Bosch to Acura: new automotive developments.

-

On The Jeep Grand Cherokee, 2022 Nissan Pathfinder, and More

An inside look at the Detroit Assembly Complex-Mack; a innovative approach to waste-free, two-tone painting; why a forging press is like an F1 car; and other automotive developments.

.jpg;width=70;height=70;mode=crop)