Gardner’s Industry Buying Influence Study 2022: Behavioral Considerations for Marketers

Planning with an eye toward current buyer behavior is key to keeping current and enhancing opportunities for success.

#brandbuilding

By Mark Semmelmayer, CBC

Chief Idea Officer

Pen & Inc. Marketing Communications

Since 2015, it’s been my pleasure to, semi-regularly, review Gardner Business Media’s most recent study on influences in the B2B buying sphere. The intention has always been to provide B2B marketers with a digest of Gardner’s insights. This is another of those reviews, covering their 2022 Industrial Buying Influence study. You can download the entire report here: https://www.gardnerweb.com/manufacturing-insights/ibi

A couple of preambles.

First, this is my take on Study contents as a 40+ year B2B veteran. Second, this is part one of a two-part blog, covering a behavioral and demographic snapshot of the B2B buyer. Finally, it’s written for the up-and-coming B2B marketer. Seasoned pros should read the whole report and find the kernels of wisdom relevant to you.

Let me start with thinking about changes in Gardner’s frame of reference. Through 2019, the report was titled “Survey of Media Usage in Manufacturing.” In its current incarnation, the title is “Industrial Buying Influence.” That may seem subtly different, but it’s really not. Time, COVID and a shifting digital environment are redefining the concept of “media” as related to B2B.

That’s the first big take-away. We’ve known for a while that how customers get and use information is changing. This confirms it. It’s not that traditional print or trade shows are completely outdated, but they’re becoming useful companion tools rather than focal points.

So, as the consumption of the media and information that frames buyer intentions and preferences continues to change, what needs to be kept in mind? Gardner pointed to three key considerations:

Digital Discernment

As industrial buyers continue to use digital channels to influence their purchase processes, they are becoming considerably more selective in the sources they access. They prioritize industry sources, vendor websites, search returns and social media from sources they know and trust.

Privacy Matters

A primary influence on the industrial community’s digital discernment is privacy and security. Manufacturing pros are much more sensitive to issues related to personal and professional data and privacy.

Solutions Networking

Industrial manufacturers are solutions networkers. They’re looking for the best solutions for their specific needs, and look first to industry sources in seeking answers to their questions.

In a word, borrowing from Billy Joel, it’s a matter of trust. First and foremost.

Building that trust in your brand, and the information you provide for buyer enlightenment, isn’t going to be accomplished in an ad, blog or website. It’s the result of a brand building process that begins long before that buyer ever identifies his or her need.

Think about that in relation to your own life. You have a big decision to make and want to talk it over with someone. Is it that guy you just met on the street? Nope…you turn to a trusted friend or relative.

The buyers’ dilemma isn’t much different. They’ll go first to what they know first.

On to more concrete facts on buyer psychographics:

- B2B buyers are problem solvers and information seekers. Understanding how, where, and why purchase decision makers and influencers access information is the first step in planning successful marketing strategies. If you aren’t familiar with the concept of Integrated Marketing Communications (IMC), it’s time to go to school on it . . . because . . .

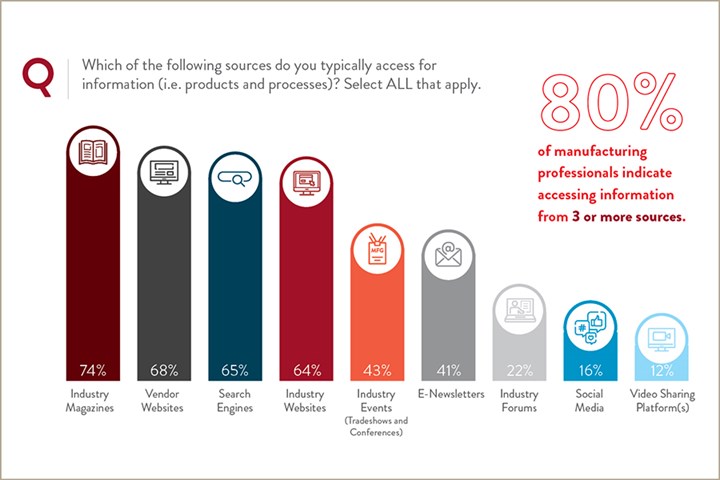

- 80% of buyers indicate they access information from three or more sources.

- Industry magazines are the most accessed resource for finding information. In digital sources, reputation plays a significant role. Vendor websites and industry websites both rate favorably. With regard to non-industry sources, search is much more accessed than social media.

- When purchasers are looking for information on specific vendors or suppliers, they’re most likely to turn to industry magazines or visit the websites of vendors they already know and trust.

- While not directly related to a stage in the purchase process, data and privacy are topics of concern to the buying community. That’s evident by “none” being the #1 response to a question regarding various media outlets respect for personal data and privacy. There’s an opportunity here for messaging that clearly shows your degree of respect for data privacy. It’s important to think about how privacy concerns and data use tactics will impact your marketing.

- Nearly 65% of buyers are in the market on either a year-long or as-needed basis. Consistent presence of brand marketing messages is important to capitalize on those windows of opportunity.

- 49% of respondents were ultimate purchase decision makers; over 90% of respondents had a direct role in the decision process.

- 75% of the responses indicate a buying committee of 1-6 individuals was involved in the decision process.

- Top three titles for decision makers or influencers in the buying process (descending order-over 50% each): Owner/Executive, Manager, Engineer.

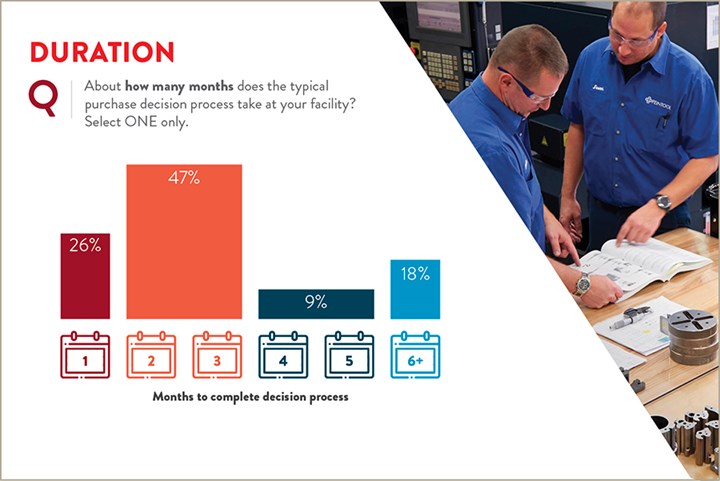

- Almost 75% of respondents indicated a purchase decision took less than 90 days. This is much quicker than previous surveys, indicated at around 4 months.

- Post-COVID, the utilization and credibility of industry-specific events, like trade shows, conferences, and seminars, is seeing a dramatic rise. More than 50% of respondents indicated a likelihood to participate in one or more events. That same number found them to be a strong networking tool and a credible source for product information.

I could add more to this blog but won’t. It’s a digest. Reminds me of a creative director I knew at an ad agency. Unlike many creatives, he believed in the power of research to help craft messages. One of his favorite phrases about creating for a specific audience was “let’s follow it down the street and see what it eats.”

Guess these thoughts are some breadcrumbs to follow . . .

I’ll go on record saying this brief overview doesn’t do the report the justice. I encourage you to download and “study the study.” There’s much there of value.

For those without the inclination to read the long version. I’ll follow this blog with a Part 2 soon, providing some facts and figures about specific media usages and how they might fit into tactics to execute your marketing plan.

Need more information?Mark Semmelmayer, CBC

Chief Idea Officer

Pen & Inc. Marketing Communications

Saint Simons Island, GA

770-354-4737

About the Author

Mark Semmelmayer, CBC

Mark is a past international chairman of the Business Marketing Association (BMA), the 2015 recipient of BMA’s prestigious G.D. Crain Award and an Inductee into the Business Marketing Hall of Fame. A 40-year B2B marketing pro, including 32 years with Kimberly-Clark, he’s the founder and Chief Idea Officer of Pen & Inc. Marketing Communications, a consultancy in Saint Simons Island, GA.

RELATED CONTENT

-

The Fisherman Approach to Print Advertising

Hook-less ads are a waste of money. Trade magazines with lots of information-hungry readers represent oceans of possibilities. You just need to know which bait to use. Here are some ideas to stop readers and reel them in.

-

Veteran Marketers Know How Print Plays in Their Plans. Do You?

There’s more than enough research showing print engenders higher recall and a satisfying social effect with readers.

-

Marketing Messages That Cut Through The Noise

We’ve talked about customer journeys, emotional intelligence, and finding and retaining customers. You’ve tuned up your marketing messages. Now it’s time to decide where to place them, so customers tune in. In a world with endless channels of information, how do you become a source of knowledge — not noise? One step at a time.